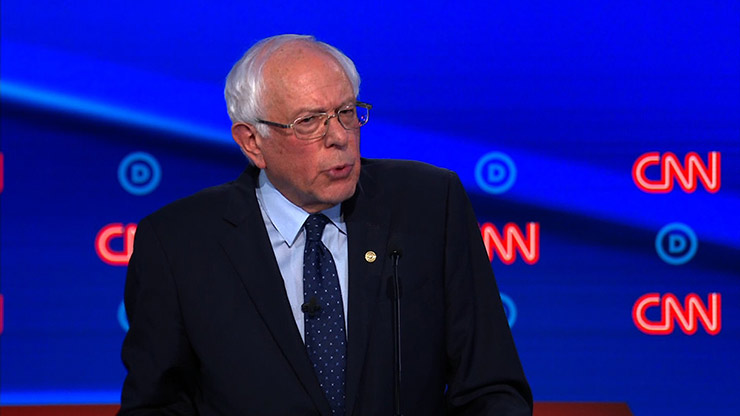

Sen. Bernie Sanders claimed that Amazon pays not “one nickel” in federal income taxes.

“Companies like Amazon that made billions in profits did not pay one nickel in federal income tax.”

Facts First: Sanders is correct — for the previous two tax years, Amazon’s own financial filings showed that it expected to receive money back from the federal government, not that it owed money.

According to an analysis by the Institute on Taxation and Economic Policy for the second year running, Amazon made a profit of more than $11 billion in 2018, but reported a $129 million tax rebate from the federal government.

Amazon does pay state taxes, and has also paid federal taxes in the past. The Wall Street Journal reported recently that Amazon’s overall tax rate from 2012 through 2018 was 8%.“From 2012 through 2018, Amazon reported $25.4 billion in pretax US income and current federal tax provisions totaling $1.9 billion,” the Journal reported. “That is an 8% tax rate — low, but not zero or negative. Looking back further, since 2002, Amazon has earned $27.7 billion in global pretax profits and paid $3.6 billion in global cash income taxes, a 13% tax rate.”

Amazon’s SEC filings in 2017 show it did not expect to owe any federal tax, and in fact expected to get a $137 million refund from the federal government. It did, however, say it expected to pay $211 million to states.